Transferring money from bKash to Nagad in Bangladesh is simple and hassle-free.

If you’re looking for a hassle-free way to transfer money from bKash to Nagad in Bangladesh, you’ve come to the right place! In this guide, we will walk you through the process of making a secure transaction from start to finish.

Whether you’re a first-time user or just need a refresher, our step-by-step instructions will ensure a smooth money transfer experience.

One thing you must remember is that both the sender and the recipients have the bKash and Nagad accounts on the desired number. Then you can successfully transfer money from bKash to Nagad.

Step-By-Step Guide to Transfer Money From bKash to Nagad

Transferring money from bKash to Nagad is a simple and secure process. To initiate the transaction, follow these steps:

1. Dial the bKash USSD Code (*247#) on Your Mobile

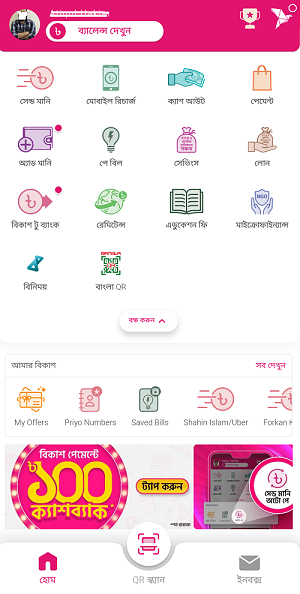

If you have a bKash account and the bKash mobile application is installed on your phone, then you need to just log in to your bKash app. After logging in to the bKash mobile app, you can see the “Send Money” option on the homepage.

On the other hand, if you don’t have the bKash mobile application installed on your phone, just dial *247# from your mobile and you can see the send money option.

2. Select the “Send Money” Option from the Menu

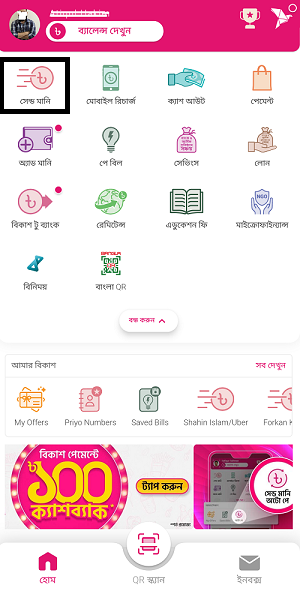

From the bKash mobile app, you can see the Send Money option on the upper section of the homepage. Click on it and you’ll get a new page.

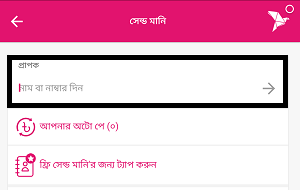

3. Enter the Recipient’s Nagad Mobile Number

After clicking the Send Money option, you will get a new page where you can put down your recipient’s mobile number. Besides, if your recipient number is already saved on your contact list, you can add it from there.

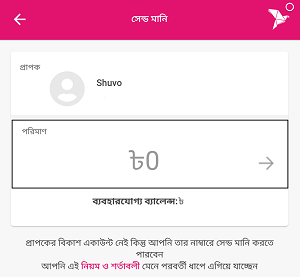

4. Enter the Amount You Wish to Transfer

Put down the number carefully and check the number is okay to go. Click the arrow and now you’ll see the page where the amount you want to send to the Nagad account will appear. Now enter the amount.

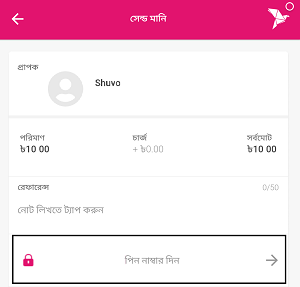

5. Provide Your bKash PIN to Confirm the Transaction

Now, you are in the final step, you have to enter your bKash pin number to allow the transfer. Here you should again check the number and the amount. If okay, after entering your PIN number, proceed to the complete step. You’ll get a text message from bKash that your transfer is successful.

By following these steps, you can initiate the money transfer securely and effortlessly. However, it’s essential to ensure the accuracy of the recipient’s Nagad mobile number and the amount you intend to transfer.

Important Requirements and Considerations For The Transfer

Before proceeding with the money transfer, there are a few important requirements and considerations to keep in mind:

- Sufficient bKash balance: Make sure you have enough balance in your bKash account to cover the desired transfer amount, including any applicable fees.

- Active mobile connection: Ensure that your mobile device has an active connection to initiate the transaction successfully.

- Correct Nagad mobile number: Double-check the recipient’s Nagad mobile number to avoid any errors or potential transfer issues.

- Transaction limit: Be aware of the daily transaction limits set by bKash and Nagad. If your desired transfer amount exceeds the limit, you may need to split the transfer into multiple transactions.

- Transfer fees: Take into account any fees associated with the money transfer. Familiarize yourself with the fees charged by both bKash and Nagad to avoid any surprises.

By fulfilling these requirements and considering these factors, you can ensure a smooth and hassle-free transfer of money from bKash to Nagad. Always prioritize accuracy, security, and convenience when engaging in financial transactions.

Now that you have a clear understanding of the process of transferring money from bKash to Nagad, you’re ready to make your first transaction. Follow the steps we’ve provided, and soon you’ll be seamlessly transferring money between these two popular mobile financial services in Bangladesh.

Benefits of Transferring Money Between bKash and Nagad

An increasing number of people in Bangladesh are turning to mobile financial services for transferring money between bKash and Nagad. These two popular platforms provide a convenient and accessible way to conduct transactions. In this section, we will explore the benefits of utilizing these mobile financial services for money transfers.

Convenience and Accessibility of Using Mobile Phones For Transactions

- With bKash and Nagad, users can easily transfer money using their smartphones, eliminating the need to visit a physical bank branch or ATM.

- The mobile apps for these platforms are user-friendly, making it simple for even tech-savvy individuals to use.

- Mobile transactions can be done anytime, anywhere, providing unparalleled convenience.

- Users can send and receive money, pay bills, and make purchases directly from their mobile devices.

Cost-Effectiveness Compared to Traditional Banking Methods

- Traditional banking methods can often be costly and time-consuming, with fees and paperwork to navigate. On the other hand, bKash and Nagad offer low transaction fees, making it an affordable option for the majority of users.

- Users can quickly transfer money between the two platforms, saving time and effort compared to traditional banking methods.

- These mobile financial services also eliminate the need for carrying cash, reducing the risk of loss or theft.

- Additionally, by utilizing mobile financial services, users can avoid the hassle of dealing with physical currency and coins.

The benefits of transferring money between bKash and Nagad are evident. Users can enjoy the convenience and accessibility of using their mobile phones for transactions while also benefiting from the cost-effectiveness of these services.

With the ability to conduct transactions from anywhere, at any time, it’s no wonder that more and more individuals in Bangladesh are embracing these mobile financial services.

Comparing bKash and Nagad As Mobile Financial Services

Mobile financial services have revolutionized the way we handle money transfers in Bangladesh. bKash and Nagad are two popular choices among users, offering convenient and reliable options for transferring money.

In this section, we will compare the features and functionalities of bKash and Nagad, giving you a comprehensive understanding of the differences between these mobile financial services.

So, let’s dive in and explore the details of each service.

Features and Functionalities of bKash and Nagad

bKash

- bKash, launched in 2011, has quickly established itself as the leading mobile financial service provider in Bangladesh.

- It boasts a user-friendly interface, making it easy for both urban and rural users to navigate the platform.

- With bKash, you can access a wide range of services including money transfers, bill payments, mobile top-ups, and more.

- The platform has an extensive agent network, ensuring that you can access bKash services conveniently, even in remote areas.

- bKash also offers additional features like the bKash app and a bKash card, providing users with more flexibility and convenience in managing their finances.

Nagad

- Nagad, a newer player in the market launched in 2018, has quickly gained popularity as a reliable mobile financial service.

- It offers a simple and intuitive interface, allowing users to easily navigate and access its various features.

- Nagad provides users with a wide range of services, including money transfers, bill payments, mobile top-ups, and more, similar to bKash.

- It has rapidly expanded its agent network across the country, providing users with widespread access to Nagad services.

- Nagad also offers a digital KYC (know your customer) verification process, making it easier for users to register and use the platform.

Transaction Fees, Transaction Limits, and Transfer Speed

bKash

- bKash provides affordable transaction fees, making it an attractive option for users.

- The platform also offers competitive transaction limits, allowing users to transfer larger amounts of money if required.

- Transfer speed with bKash is typically fast and convenient, ensuring that your transactions are completed promptly.

Cash Out Charge of bKash

- From Agent: 18.5 Tk is deducted for every 1000 Tk

- Priyo Agent Number: Cash Out at 14.90 Tk. per thousand

- From ATM: 14.9 Tk is deducted for every 1000 Tk

Send Money Charge of bKash

- On favorite numbers, sending money up to 25,000 BDT monthly incurs no charges.

- For transactions between 25,001 to 50,000 TK to Priyo numbers, a charge of 5 TK applies.

- If the monthly transaction limit of 50,000 TK is exceeded on the Priyo number, a charge of 10 TK applies per transaction.

Transaction Limit of bKash

| Transaction Limits | ||||||

| Transaction Type | Maximum Number of Transactions | Amount Per Transaction | Maximum Amount | |||

| Per Day | Per Month | Minimum (BDT) | Maximum (BDT) | Per Day (BDT) | Per Month (BDT) | |

| Cash in from Agent | 10 | 100 | 50 | 30,000 | 30,000 | 200,000 |

| Add money from Bank and Card | 20 | 50 | 50 | 50,000 | 50,000 | 300,000 |

| Send Money | 50 | 100 | 0.01 | 25,000 | 25,000 | 200,000 |

| bKash to Bank | 10 | 100 | 50 | 50,000 | 50,000 | 300,000 |

| Mobile Recharge | 50 | 1,500 | 20* | 1,500* | 10,000 | 100,000 |

| Payment | No Limit | No Limit | 1 | No Limit | No Limit | No Limit |

| Cash Out from Agent | 10 | 100 | 50 | 25,000 | 25,000 | 150,000 |

| Cash Out from ATM (Partner Banks) | 3,000 | 20,000 | ||||

| Cash Out from ATM (BRAC Bank) | 3,000 | 10,000 | ||||

Nagad

- Nagad also offers competitive transaction fees, providing users with cost-effective options for money transfers.

- Similar to bKash, Nagad has competitive transaction limits, allowing users to transfer significant amounts of money.

- Transfer speed with Nagad is generally quick, ensuring that your funds are transferred promptly when needed.

Cash Out Charge of Nagad

- USSD code or Agent: 15 Tk for every 1000 Tk

- Nagad App: 11.49 Tk for every 1000 Tk

- Nagad Islami Account: 15 TK for every 1000 Taka

Send Money Charge of Nagad

- If you send money using USSD, you will be charged 5 Tk.

- If you use the Nagad app to send money, there won’t be any charges, and it will be free of cost.

Transaction Limit of Nagad

| Services | Limit | Range per TXN | ||||

|---|---|---|---|---|---|---|

| TXN Amount (Daily) | TXN Count (Daily) | TXN Amount (monthly) | TXN Count (Monthly) | Min | Max | |

| Send Money (*167#) | 25,000 | 50 | 200,000 | 100 | 10 | 25,000 |

| Send Money (App) | ||||||

| Cash Out (*167#) | 25,000 | 5 | 150,000 | 20 | 50 | 25,000 |

| Cash Out (App) | ||||||

| Cash In | 80,000 | 200 | 300,000 | 600 | 50 | 30,000 |

| Check Balance (*167#) | Not Applicable | Not Applicable | Not Applicable | Not Applicable | Not Applicable | Not Applicable |

| Check Balance (App) | Not Applicable | Not Applicable | Not Applicable | Not Applicable | Not Applicable | Not Applicable |

Availability of Services and Agent Networks

bKash

- bKash has a vast agent network, making its services accessible throughout Bangladesh.

- Whether you are in a major city or a remote village, bKash agents are readily available to assist you with your financial needs.

- They have partnered with numerous retail shops, allowing customers to conveniently access their services while performing everyday errands.

Nagad

- Nagad has been expanding its agent network rapidly, ensuring the widespread availability of its services.

- Users can find Nagad agents in various locations, including small shops, retail outlets, and supermarkets.

- This widespread agent network makes it easier for users, regardless of their location, to access Nagad’s services conveniently.

By comparing the features and functionalities of bKash and Nagad, evaluating transaction fees, transaction limits, and transfer speed, and understanding the availability of services and agent networks, you can make an informed decision when choosing the most suitable mobile financial service for your needs.

Whether it’s bKash’s extensive agent network or Nagad’s competitive transaction fees, both services offer reliable options for transferring money in Bangladesh.

Ensuring Security and Fraud Prevention

The Security Measures Implemented by bKash and Nagad

When it comes to transferring money online, ensuring security and fraud prevention are paramount concerns for users. Both bKash and Nagad, two popular mobile financial service providers in Bangladesh, have implemented robust security measures to protect their users’ personal and financial information during the transfer process.

To provide a secure money transfer experience, bKash and Nagad have implemented the following security measures:

- Encryption: All transactions made through the bKash and Nagad platforms are encrypted using advanced encryption standards. This ensures that any sensitive information shared during the transfer, such as passwords or account details, remains safe from unauthorized access.

- Two-factor authentication: Both bKash and Nagad utilize two-factor authentication to verify the identity of users. This adds an extra layer of security by requiring users to provide a unique code or password in addition to their regular login credentials.

- Secure servers: bKash and Nagad store user data on secure servers that are protected by advanced firewalls and intrusion detection systems. These measures prevent unauthorized access and ensure the safety of user information.

- Fraud monitoring: To detect and prevent fraudulent activities, bKash and Nagad employ sophisticated fraud monitoring systems. These systems analyze transaction patterns and user behavior to identify any suspicious activity, allowing for immediate action to be taken to mitigate potential risks.

How to Protect Personal and Financial Information During The Transfer?

While bKash and Nagad have implemented strong security measures, it is equally important for users to play an active role in protecting their personal and financial information during the money transfer process. Here are some tips to consider:

- Keep your login credentials secure: Create strong passwords and change them regularly. Avoid sharing your login details with anyone and refrain from using the same password for multiple accounts.

- Beware of phishing scams: Be cautious of emails, text messages, or calls asking for personal or financial information. Legitimate service providers like bKash and Nagad will never request such details through unsolicited communications.

- Verify the recipient’s information: Double-check the recipient’s account details before initiating the transfer. Ensure that you are sending money to the correct person or entity to avoid any potential scams.

- Regularly monitor your transactions: Keep an eye on your account activity to quickly detect any unauthorized or suspicious transactions. Report any discrepancies or issues to the respective service provider immediately.

- Educate yourself about common scams and fraud techniques: Stay up to date with the latest scam techniques and fraud prevention strategies. Being aware of common scams can help you identify and avoid potential threats.

By being vigilant and following these security practices, you can further safeguard your personal and financial information while transferring money through bKash or Nagad.

Remember, your active participation in maintaining security is essential alongside the measures implemented by the service providers themselves.

Frequently Asked Questions

Can I Transfer Money From bKash To Nagad in Bangladesh?

Yes, you can transfer money from bKash to Nagad in Bangladesh using the mobile banking platforms’ interoperability feature. It allows seamless transfer of funds between the two platforms, providing convenience and flexibility to users.

How Can I Transfer Money From Bkash to Nagad?

To transfer money from bKash to Nagad, follow these simple steps: (1) dial the USSD code for bKash transfer, (2) select the ‘Send Money’ option, (3) enter the Nagad account number, (4) enter the amount to be transferred, and (5) confirm the transaction.

Are There Any Charges For Transferring Money From bKash to Nagad?

Yes, there are charges associated with transferring money from bKash to Nagad. Usually, a certain percentage of the transaction amount or a fixed fee is deducted as the transfer fee. It is advisable to check the respective platforms’ official websites for the latest fee structure.

Is There a Limit on The Amount I Can Transfer From bKash To Nagad?

Yes, there are limits on the amount you can transfer from bKash to Nagad. The limits may vary depending on factors such as the user’s account type, transaction frequency, and verification level. It is recommended to refer to the terms and conditions of both platforms for specific limits.

How Long Does It Take For The Money to Be Transferred From bKash to Nagad?

Generally, money transfers from bKash to Nagad are processed instantly. However, the actual time may vary depending on factors such as network availability, system maintenance, and other technical aspects. It is advisable to keep track of the transaction status and contact customer support if any delays occur.

Can I Transfer Money From bKash to Nagad Using a Smartphone App?

Yes, you can transfer money from your bKash account to Nagad using the respective mobile apps provided by both platforms. These apps offer a user-friendly interface and additional features to enhance the overall experience of transferring funds. Simply download the apps from your app store and follow the instructions to initiate the transfer.

Don’t miss out on the top deals of the year! Mark your calendar, set your reminders, and get ready for the shopping spree of a lifetime.

Conclusion

Transferring money from bKash to Nagad in Bangladesh has never been easier. With the convenience and accessibility of digital wallets, individuals can now send and receive funds with just a few clicks. By following the step-by-step process discussed in this blog post, users can avoid the hassle of physical visits to banks or money transfer agents.

This efficient method ensures fast and secure transactions, saving time and effort for both the sender and the receiver. Whether it’s for personal or business purposes, transferring money between bKash and Nagad offers a seamless experience, allowing individuals to manage their finances conveniently.

As digital payment systems continue to evolve, it is crucial to stay updated with the latest methods and procedures to make the most out of these financial solutions. So, start transferring money smoothly between bKash and Nagad today and enjoy the benefits of this modern payment ecosystem in Bangladesh.

Shuvo Roy, an enthusiastic Content Writer & Researcher, has expertise in several industries, especially in IT, Software & E-commerce. Moreover, he is a strategic planner.